17+ Subprime mortgage

The value of US. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis.

How Long Does A Refinance Take Loan Officer Kevin O Connor

In 1955 the firm opened its.

. Conflicts causing at least 1000 deaths in one calendar year are considered wars by the Uppsala Conflict Data Program. Internal tensions quickly arose among the three founders. Subprime mortgages was estimated at 13 trillion as of March 2007 with over 75 million first-lien subprime mortgages outstanding.

They are currently operated by Hilcorp San. GIC Private Limited is a sovereign wealth fund to manage Singapores foreign reservesEstablished by the Government of Singapore in 1981 as the Government of Singapore Investment Corporation its mission is to preserve and enhance the international purchasing power of the reserves with the aim to achieve good long-term returns above global inflation. In 2007 it filed for bankruptcy protection.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of. Several major financial institutions collapsed in September 2008 with significant.

Travelers was subsequently spun off from the company in 2002. First Horizon National Corp. The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based.

It was characterized by a rise in subprime mortgage delinquencies and foreclosures and the resulting decline of securities backed by said mortgages. Subprime mortgage company New Century Financial made nearly 60 billion in loans in 2006 according to the Reuters news service. Impact on Europe Public debt to GDP ratio for selected European.

The Home Mortgage Disclosure Act HMDA was enacted by Congress in 1975 and was implemented by the Federal Reserve Boards Regulation C. In the late 1800s and early 1900sIn 1968 Ginnie Mae was the first to issue a new type of government-backed bond known as the residential mortgage-backed security. Sa n Juan Basin R oyalty Trust is a medi um sized gas trust it produces a negligible amount of oil set up by Southland Royalty Company.

62717 - Two sets of APORs for the weeks of January 9 and January 16 2017. If youre in the. United States housing prices experienced a major market correction after the housing bubble that peaked in early 2006Prices of real estate then adjusted downwards in late 2006 causing a loss of market liquidity and subprime defaults.

The Federal National Mortgage Association FNMA commonly known as Fannie Mae is a United States government-sponsored enterprise GSE and since 1968 a publicly traded companyFounded in 1938 during the Great Depression as part of the New Deal the corporations purpose is to expand the secondary mortgage market by securitizing mortgage loans in the. The firm survived the Wall Street Crash of 1929 without laying off any employees and by 1933 opened its first branch office in Chicago. Approximately 16 of subprime loans with adjustable rate mortgages ARM were 90-days delinquent or in foreclosure proceedings as of October 2007 roughly triple the rate of 2005.

San Juan Basin Royalty Trust SJT Dividend Yield. And placed it into receivership with the. Washington Mutual Incabbreviated to WaMuwas a savings bank holding company and the former owner of WaMu Bank which was the United States largest savings and loan association until its collapse in 2008.

Subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Todays national mortgage rate trends.

New vehicle sales which peaked at 17 million in 2005 recovered to only 12 million by 2010. Divested its subprime mortgage loan portfolio First Horizon discontinued national construction and commercial lending 160 layoffs First Horizon to sell or shut down mortgage unit. On July 21 2011 the rule-writing authority of Regulation C was transferred to the Consumer Financial Protection Bureau CFPB.

Dover Mortgage Co. Established in 1694 to act as the English Governments banker and still one of the bankers for the Government of the United Kingdom it is the worlds eighth-oldest bankIt was privately owned by stockholders from its foundation in 1694 until it. It includes United States enactment of government laws and regulations as well as public and private actions which.

By January 2008 the delinquency rate had risen. Stearns and Harold C. Fannie Mae is short for the Federal National Mortgage Association one of two government-sponsored enterprises GSE that provides lenders with the cash needed to fund home loans with affordable mortgage ratesIn turn lenders use the cash raised selling mortgages to Fannie Mae to fund new loans which adds stability to the US.

Bear Stearns was founded as an equity trading house on May 1 1923 by Joseph Ainslie Bear Robert B. A mortgage in itself is not a debt it is the lenders security for a debt. Use our free mortgage calculator to estimate your monthly mortgage payments.

Citigroup owns Citicorp the holding. Account for interest rates and break down payments in an easy to use amortization schedule. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

In finance subprime lending also referred to as near-prime subpar non-prime and second-chance lending is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. To shut down Downey Savings shut down by the FDIC. High-Yield Monthly Dividend Stock 17.

What is Fannie Mae. Mortgage loan basics Basic concepts and legal regulation. On Thursday September 25 2008 the United States Office of Thrift Supervision OTS seized WaMu Bank from WaMu Inc.

The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble and the 2005 housing bubble burst or market correction and the subprime mortgage crisis which developed during 2007 and 2008. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

In 2008 the Northern Rock bank was nationalised by the British government due to financial problems caused by the subprime mortgage crisisIn 2010 the bank was split into two parts assets and banking to aid the eventual sale of the bank back to the private sectorOn 14 September 2007 the bank sought and received a liquidity support facility from the Bank of. Wars 10009999 combat-related deaths in current or past year The 17 conflicts in the following list have caused at least 1000 and fewer than 10000 direct violent deaths in a current or past calendar year. Mayer with 500000 in capital.

Historically subprime borrowers were defined as having FICO scores below 600 although this threshold has varied over time. A real estate bubble is a type of economic bubble that occurs periodically in local regional national or global real estate markets. On Wednesday September 14 2022 the current average rate for a 30-year fixed mortgage is 624 up 13 basis points over the last week.

Cut 17 employees Downeast Mortgage Corp. Or Citi stylized as citi is an American multinational investment bank and financial services corporation headquartered in New York CityThe company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998. The origins of modern residential mortgage-backed securities can be traced back to the Government National Mortgage Association although variations on mortgage securitization existed in the US.

The producing properties are all in northern New Mexico in the San Juan Basi n.

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

The Loan Process Bill Mervin Team At Apex Home Loan

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

Identifying And Trading A Bear Market

Los Angeles California Mortgage Rates Loan Officer Kevin O Connor

San Diego California Mortgage Rates Loan Officer Kevin O Connor

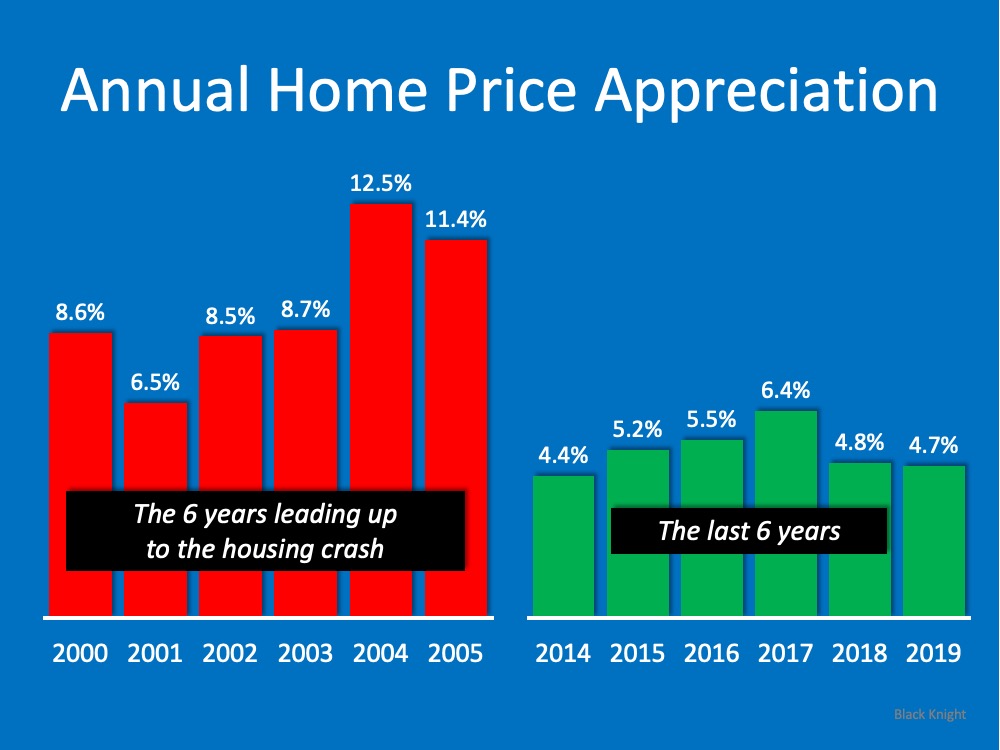

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team

Today S Mortgage Rates In California Loan Officer Kevin O Connor

21 Mortgage Statistics That Come As No Surprise In 2022

Identifying And Trading A Bear Market

Bluprint Home Loans Home Facebook

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team

About Rick Orlando Mortgage Buyers Refinancing

Identifying And Trading A Bear Market

2

San Jose California Mortgage Rates Loan Officer Kevin O Connor

American Homes Underwater Subprime Mortgage Crisis Jenns Blah Blah Blog Subprime Mortgage Crisis Mortgage Underwater